Executive Summary: The EV Darling Hits a Pothole

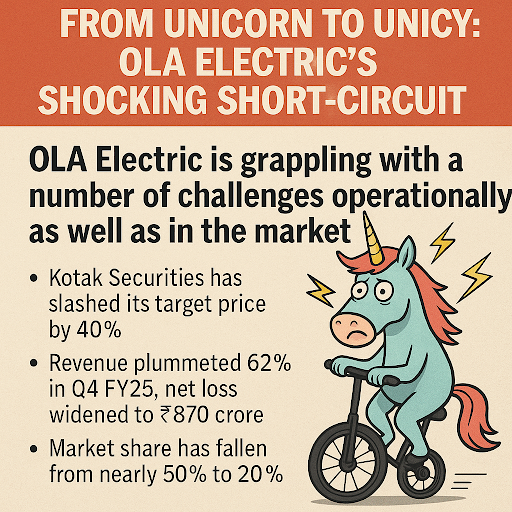

Once hailed as India's electric vehicle (EV) poster child, Ola Electric is now grappling with a series of setbacks that have jolted investor confidence and market standing. Kotak Securities has slashed its target price for the company by 40%, citing escalating losses, dwindling brand equity, and intensifying competition.

📉 Financial Freefall: A Tale of Tumbling Numbers

In Q4 FY25, Ola Electric reported a staggering 62% drop in revenue, plummeting to ₹649 crore from ₹1,641 crore the previous year. Net losses more than doubled to ₹870 crore, up from ₹417 crore in Q4 FY24. This financial nosedive led to a nearly 10% crash in share prices, reflecting eroding investor trust.

🔍 Kotak's Verdict: Proceed with Caution

Kotak Securities' decision to reduce the target price to ₹30 from ₹50 underscores concerns about Ola Electric's future. The brokerage highlights ongoing EBITDA losses and warns that the company's ambitious plans, especially in the motorcycle segment, face execution and credibility challenges.

📊 Market Dynamics: Competitors Accelerate Ahead

Ola Electric's market share has seen a significant decline, dropping from nearly 50% in May 2024 to just 20%. Rivals like TVS Motor and Bajaj Auto have capitalized on this downturn, overtaking Ola in market dominance. Ather Energy, another competitor, reported improved financial performance in the same period, highlighting the growing divergence in the EV startup landscape.

⚠️ Regulatory Scrutiny: Under the Microscope

Ola Electric is facing increased regulatory scrutiny due to discrepancies between reported sales and actual vehicle registrations. For instance, the company claimed to have sold 25,000 vehicles in February, while only 8,600 were registered according to the Vahan Portal. This has led to inspections and even seizures of scooters in various states, further tarnishing the company's reputation.

🛠️ Strategic Shifts: A Road to Recovery?

In response to these challenges, CEO Bhavish Aggarwal announced plans to focus on capital discipline and risk management. The company aims to reduce operating expenses by ₹90 crore per month through measures like headcount optimization and network transformation. However, analysts remain skeptical about the effectiveness of these strategies in the face of mounting competition and operational hurdles.

📌 Conclusion: A Cautionary Tale in the EV Revolution

Ola Electric's journey serves as a stark reminder that rapid growth without robust operational foundations can lead to significant pitfalls. As the company navigates this turbulent phase, stakeholders and investors will be keenly watching for tangible improvements and strategic clarity.